- Sustainable Development

- Sustainability Report

- Sustainable Environment

- Sustainable Supply Chain Management

- Friendly Workplace

Risk Management and Procedures

To establish a robust risk management mechanism, the Company enhances risk awareness and adopts comprehensive management of potential risks through the processes of identification, assessment, control, and monitoring, thereby ensuring stable operations and improving corporate governance effectiveness. On November 5, 2025, the Board of Directors approved the establishment of the “Risk Management Policy and Procedures” (hereinafter referred to as “the Policy”) as the highest guiding principle for all departments in implementing risk management.

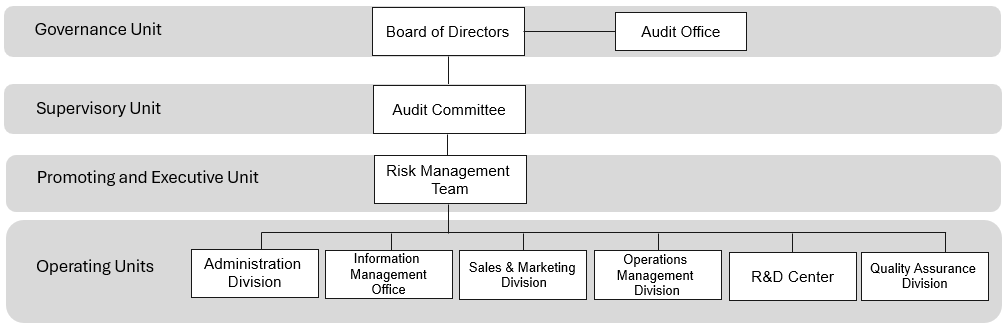

The Audit Committee is responsible for overseeing and supervising the Company’s overall risk management efforts and shall report to the Board of Directors at least once a year on the promotion and implementation status of risk management to ensure the effective execution of related policies and measures.

Scope of Risk ManagementThe scope of the Company’s risk management primarily encompasses strategy risks, operational risks, financial risks, information risks, and compliance risks associated with the Company’s operations.

| Scope of Risk Management | Explanation |

| Strategic Risk | Potential risks faced by the Company during the formulation and implementation of its strategies, such as industry risks and investment risks. |

| Operational Risk | Risks encountered in day-to-day operations, such as human errors, equipment failures, supplier issues, natural disasters, and other operational disruptions. |

| Financial Risk | Risks primarily arising from the management of the Company’s assets and liabilities, as well as changes in market and economic conditions. These include accounts receivable credit risk, interest rate risk, foreign exchange risk, and other related financial exposures. |

| Information Risk | Risks faced by the Company in the use of information technology and resources, such as technical issues, unauthorized intrusions, and intentional or unintentional human errors. |

| Compliance Risk | Risks that the Company may face as a result of failing to comply with applicable laws and regulations, including legal compliance risks, regulatory risks, and other related compliance exposures. |

Risk Management Organizational Structure

Operational Status

On November 5, 2025, the Company’s management team reported to the Board of Directors on the annual operational status of the Risk Management Team. Management proposes corporate strategies to the Board of Directors, and the Board reviews the progress of these strategies and, when necessary, instructs the management team to make appropriate adjustments.

Risk Management Policies and Procedures : File Download